1000+

customers

50+ countries

across the world

Outsourcing leader

since 2008

Technology-driven

services

Stringent

quality processes

Virtual Bookkeeping: Everything You Need to Know [Infographic]

Last updated: 23 Aug, 2023 By Ashish Rana | 6 Minutes Read

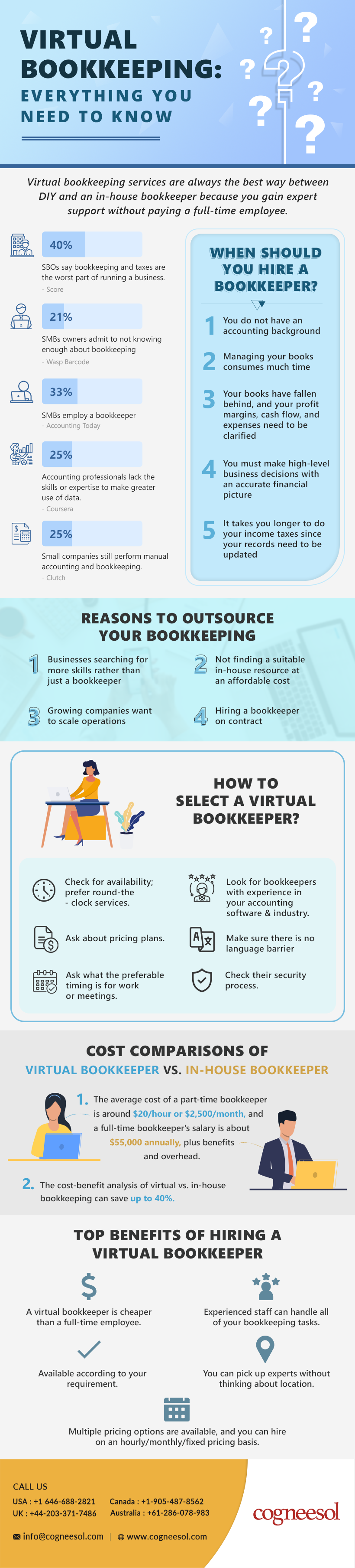

Maintaining your accounting records is always one of the most critical tasks for businesses. So, hiring virtual bookkeeping services is always the best way between DIY and an in-house bookkeeper because you gain expert support without paying a full-time employee. It allows faster customer service, greater accessibility, and consistent business financial monitoring. You can access thousands of bookkeepers from any location to keep your financial data up to date.

Accurate bookkeeping is essential for understanding a company’s financial health and identifying potential monetary challenges. To maintain a clear picture of the organization’s finances, consistent record-keeping on a weekly or monthly basis is crucial.

Integrating various components and steps, bookkeeping is indispensable for every business, containing tasks such as:

- Documenting all financial transactions, including payments and expenses.

- Recording debits and credits accurately.

- Generating vital financial statements like the balance sheet, income statement, and cash flow statement.

- Managing invoices and facilitating payment processing.

- Ensuring the integrity of the general ledger through meticulous maintenance and balancing.

- Handling day-to-day banking operations.

- Executing essential payroll functions.

A well-organized bookkeeping system is the cornerstone of financial stability and success for any business.

Do you still need to figure out how virtual bookkeeping services benefit your business?

Have a look at the following infographic to learn everything about virtual bookkeeping in detail:

Latest Blogs

This site is protected by reCAPTCHA. Google's Privacy Policy

and Terms of Service apply.