Tax Preparation Outsourcing Services

Many business establishments, tax firms, accounting firms and CPAs worldwide struggle with time restrictions during the busy tax season and deal with reduced utilization during the off-season. Cogneesol, an ideal tax preparation outsourcing company, can help you deal with the difficulties faced at the time of an extremely condensed tax season.

Our knowledge concerning income tax preparation, our exuberance, our commitment to our clients, and our selection of products is just the beginning of what you can expect from us. Apart from this, you can focus on improving client relationships while we manage your tax return preparation processing functions.

Outsource tax preparation services to Cogneesol and access skilled, experienced tax professionals for your staff’s support or allow them to focus on value-adding consulting and advisory services. Let our tax accountants help your firm manage workloads during peak tax season without losing quality. In addition, we assure complete data security and enable you to reduce tax return preparation costs via our fast and affordable tax preparation services.

"Cogneesol has been handling the tax computation of our partnership firm with complete accuracy and timeliness"

- A Professional Services Firm, Coventry, England

Our Tax Preparation Outsourcing Services

Individual: Form 1040, Form 1040A and Form 1040EZ

Partnership: Form No. 1065 and K-1

Corporation: Form 1120, Form 1120A and Form 1120S (for statutory corporations)

Individual: SA100

Business: SA800

Corporation: CT600

Value Added Tax: VAT100

Individual: Form T1 General

Business: Form T2, T4, T4A, T5, T5018

GST/HST Filings

GST calculations and returns

Why Choose Us

- Outsourcing tax preparation to Cogneesol saves your valuable time

- Round-the-clock professional guidance and support

- Reduce tax preparation costs

- No more fear of the IRS audit

- Assured data security

- Skilled tax preparers ensuring higher accuracy in calculations

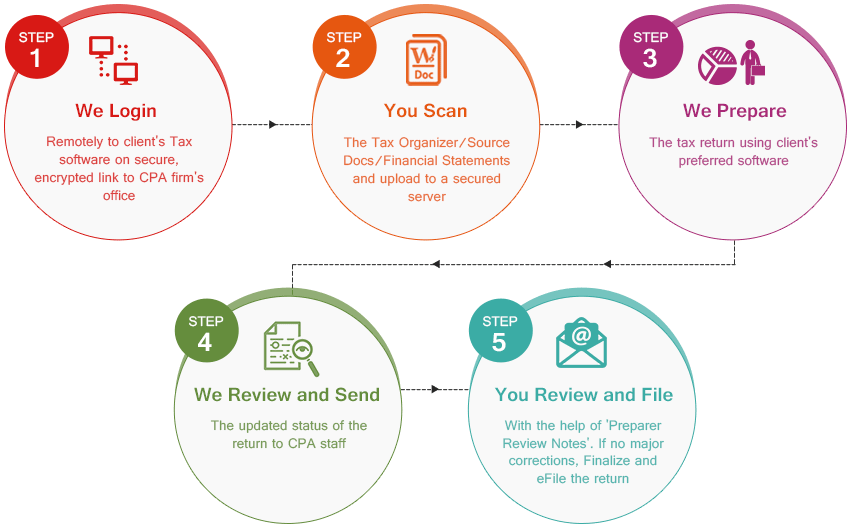

OUR 5-Step CPA Tax Preparation Process

Our Key Differentiators

Tax Compliance

We make sure that we are preparing your taxes in compliance with the tax laws to eliminate any chance of a penalty from the IRS.

Experience & Expertise

Our team is highly experienced and skilled, having more than 16 years of experience in providing proficient tax preparation solutions.

Round-The-Clock Support

We are available round-the-clock for you to address any of your concerns related to tax preparation as we aim to achieve overall customer satisfaction.

Affordability

With the team of Cogneesol handling your tax preparation tasks, you do not need to invest in hiring tax experts or buying expensive software.

The Technical Edge

We incorporate the use of the latest and most advanced software to prepare your taxes, ensuring the utmost accuracy and timely tax preparation.

Enhanced Growth

Our CPA tax preparation services can improve efficiency and profitability by freeing your resources to concentrate on higher-value client solutions.

Tax Compliance

We make sure that we are preparing your taxes in compliance with the tax laws to eliminate any chance of a penalty from the IRS.

Experience & Expertise

Our team is highly experienced and skilled, having more than 16 years of experience in providing proficient tax preparation solutions.

Round-The-Clock Support

We are available round-the-clock for you to address any of your concerns related to tax preparation as we aim to achieve overall customer satisfaction.

Affordability

With the team of Cogneesol handling your tax preparation tasks, you do not need to invest in hiring tax experts or buying expensive software.

The Technical Edge

We incorporate the use of the latest and most advanced software to prepare your taxes, ensuring the utmost accuracy and timely tax preparation.

Enhanced Growth

Our CPA tax preparation services can improve efficiency and profitability by freeing your resources to concentrate on higher-value client solutions.

How do We Prepare a Tax Return?

While preparing and processing your tax returns, we analyze and interpret profit and loss, in addition to treatment and taxability for different accounts in the course of providing outsource tax returns preparation and processing services. Before the tax return is finally prepared, we communicate our observations, comments, and viewpoints to you.

- We receive data related to tax returns in one of three modes:

- Remote access based

- Secured server-based

- E-mail based

- We scrutinize the information and feed it into the tax software of your choice.

- Following data entry and processing, we audit the information to ensure that it is correctly accounted for and entered.

- After that, we transmit the returns back to you through the transmission process you choose, along with our observations and comments.

- When the return reaches you, you can finalize, modify, and review the information as required and return it to us. We then update your tax file and send the final copy to you for filing.

Client Testimonials

Cogneesol is an expert at handling our day-to-day tax deductions, monthly compilations, and computations. They provide us the support we need for our Form 1040, Form 1040A, and Form 1040EZ filings. The team is well versed with all U.S tax legislation and provides us with timely guidance on adhoc taxation matters. It has been a valuable association with them through the years. Thank you, Cogneesol!

Cogneesol has been handling our VAT calculations and supporting the filing of returns for the past two years. The team streamlined our processes and has brought in numerous efficiencies over time. They keep themselves updated with the latest regulations, and incorporate the changes required in the process flow. Happy with their result-oriented, timely, and professional attitude. They are our business’s taxation backbone, always keeping us compliant.

GST calculations are cumbersome and require thorough and exhaustive knowledge and understanding. To save time and money, we didn’t want to have an in-house taxation team. Cogneesol offered the services we required -- we approached them for one business unit. Impressed with their service delivery and timeline adherence, we assigned them two of our other BUs as well. The business has received tremendous value from Cogneesol’s GST services.