1000+

customers

50+ countries

across the world

Outsourcing leader

since 2008

Technology-driven

services

Stringent

quality processes

How to Optimize Insurance Business Process Management for Higher Efficiency?

Last updated: 29 Feb, 2024 By Mohit Sharma | 6 Minutes Read

Insurance is a sector that depends heavily on documents as it processes high volumes of hardcopy customer forms, claims applications, and more. As a result, insurance firms have realized that they need to digitalize the complete system to mitigate the threat by Insurtech startups using insurance BPM.

However, most of them feel handicapped by the industry’s strict regulations and the legacy systems that they developed over so many years. But this compulsion of not being able to embrace digitalization can significantly cost them in the upcoming future.

“By implementing a well-designed digitization program, insurance companies can achieve up to 65 % in cost reduction and a 90% reduction in turnaround time on key insurance processes.” – Harvard Business Review”

How can Workflow Optimization help Organizations Grow?

If you observe carefully, you will probably notice that processes surround you from all directions. Whether it’s completing and editing documents, collaborating on reports or presentations, and delivering services to the customers, all business is driven by workflow. Therefore, if you make efforts to understand and enhance your business processes via digital transformation solutions, you can:

- Automate key tasks, decisions, and actions, hence, save time and resources.

- Improve clarity regarding the status of a process, user roles, and completion of tasks.

- Reduce risk through a consistent, logic-driven approach to complete operations, such as in the case of regulatory, HR, or compliance matters.

- Enhance collaboration and communication among teams.

- Improve productivity, output, and impact for your stakeholders.

Why Utilize Insurance Business Process Management (BPM)?

Financial services firms have recognized multiple benefits of insurance business process management (BPM) to increase operational efficiency and business innovation. Furthermore, many firms have claimed to achieve more than 100% rate of return on their Business Process Management implementations. While the methods used to measure the rate of return might be different for each firm, the most common way to use for this purpose is ‘cost savings per transaction.’

1. Operational efficiency

- IBPM contributes to automating manual tasks, which frees employees to concentrate on higher-value activities.

- IBPM helps in faster decision-making and improves the operation of business processes.

- IBPM tools let partners get on board and respond quickly.

- IBPM brings improvement that results in superior inventory management.

2. Business innovation

- IBPM allows agile product designing and an improved ability to implement new products.

- IBPM provides innovative ways to approach a business problem and can help overcome traditional obstacles.

- IBPM lets firms respond to customers faster and flexibly and improve the accuracy and quality of customer service.

Insurance BPM: How can it Benefit Insurers?

The insurance companies face the same challenges faced by other industries, but insurers should particularly give their attention to increasing cost-effectiveness and managing risks in a better manner. In addition, insurers must boost agent and client satisfaction to expand their market share.

To ensure this, the underlying IT systems that support insurance transactions or processes should be streamlined, agile, and flexible. Insurance companies can strategically make use of BPM technology to make IT systems robust and overcome other industry challenges.

In just a few years, insurance back office services have become a favorable choice of property, casualty, and life insurers. The adoption of IBPM mainly started in North America, but now it is picking up pace in other places such as continental Europe and Asia realizing the cost savings and process efficiencies that IBPM can bring. Major BPM initiatives for casualty and property insurance involve front office, underwriting, and claims process.

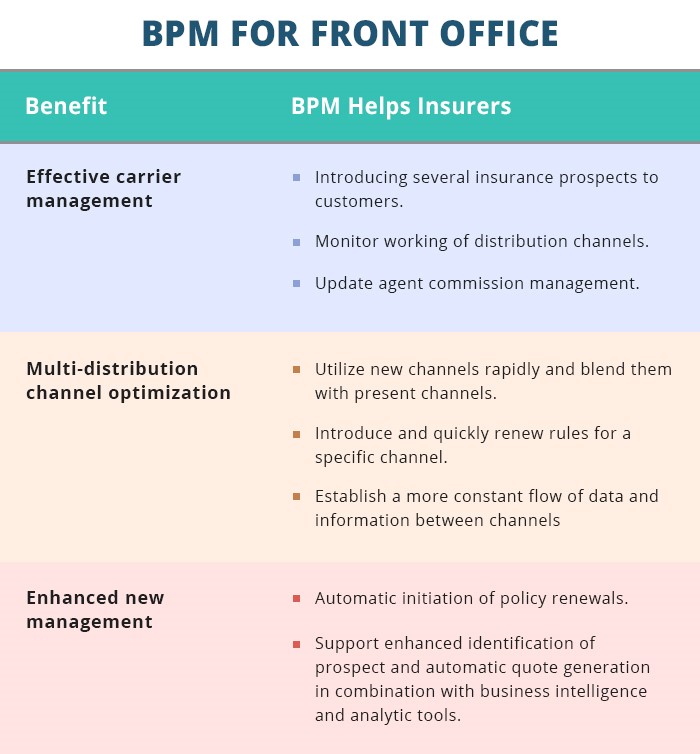

1. BPM for front office: BPM optimizes front office operations by allowing insurers to manage agents more effectively, develop multiple distributional channels, and increase renewals and new business probability. Here’s how:

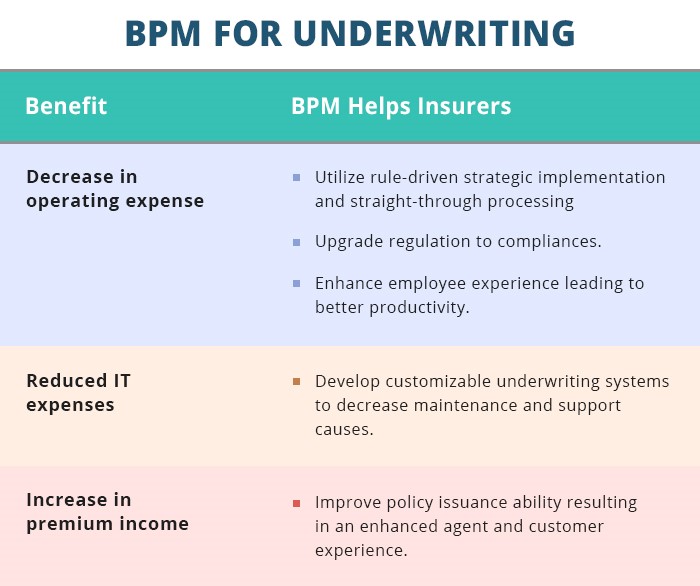

2. BPM for underwriting: Insurance business process management (BPM) can result in significant internal and external impact by increasing transparency of underwriting and policy administration and efficiently aligning underwriting with the company’s goals. Here’s how:

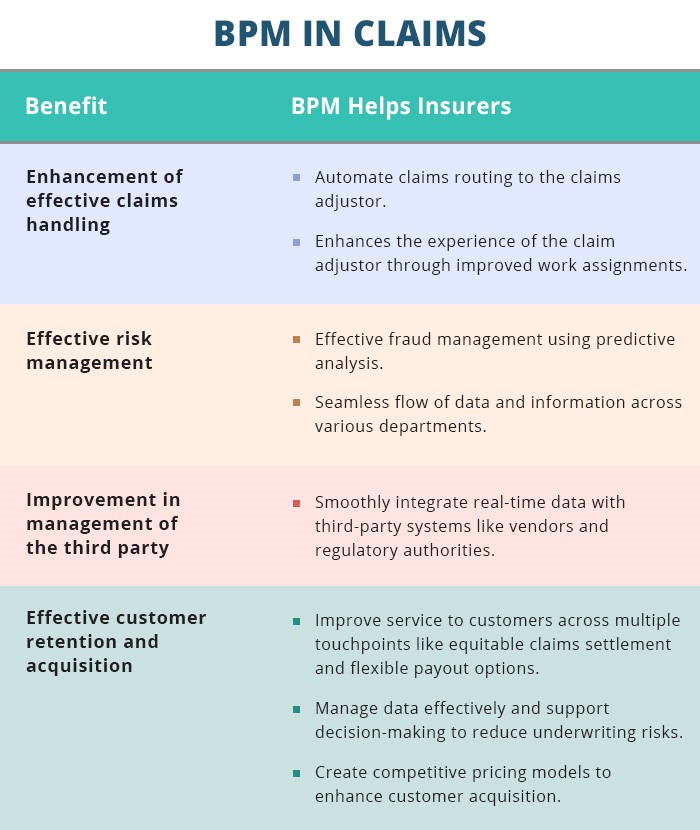

3. BPM in claims: Integrating BPM in the claims process can lead to effective processing and management of risk. Also, BPM can decrease the overall claims processing time and manage third parties in a better manner.

Ways to Optimize Insurance Business Process Workflows for Improved Efficiency

1. Adopt automation software

Workday tasks like calling, sending emails, and messages are one of the primary concerns of an insurance agent. On the outside, this work may look easy but doing this daily is a challenge itself. However, automation software can streamline the complete process, making it easier to set up tasks for the employees to timely finish their dues.

In addition, an automated workflow can list the daily tasks so that employees can manage their schedules more efficiently. Taking follow-up with customers and clients can also become more manageable with automated software as it reminds about the upcoming events.

2. Embrace digitization

Insurance companies face a significant challenge involving their PAS platform, as it is not compatible with modern customers. Reason being that customer these days want to connect with their insurance provider through digital devices (smartphone application of website). However, outdated PAS systems may not be helpful in this and can fail to provide a unified experience to the customer.

Another factor that complicates things is that Insurtech platforms may not supply essential features to improve the user experience for both customers and providers. Therefore, insurers must think of solutions to resolve this issue and adapt to today’s technological systems.

3. By reducing the processing time

Reduction in time duration of resolving claims and swiftly filling informational gaps of claims reports can improve client satisfaction and loyalty. The first claim report’s lack of basic information can delay the settlement process by 3-5 days.

Hiring external employees dealing in the claims process can be a great way to focus on essential operational strategies on time.

4. Make utility related access levels

Most insurance companies generally follow an internal processing structure in which particular responsibilities are assigned to a specific team member. The leads to creating an internal production line under which a specific duty is completed by a particular team member and then handed to the next team member to finish the remaining part.

This results in optimum management of employees’ time and increases efficiency in their work. Therefore, all insurance firms should adopt such a mechanism. All the workers should have clarity of the process they have to complete and pass on to the next person.

Furthermore, they should be given access to only the extent they require to complete the assigned task; otherwise, misunderstanding regarding specific responsibilities can erupt.

5. Build an intuitive user experience

Users are more likely to use your workflow management system if it reduces their operating efforts compared to your competitors. Usually, insurers implement insurance workflow platforms and spend significant time, money, and resources educating their employees about its utilization.

But, a more efficient and effective way would be to do things the other way around. First, learn the needs of customers and employees and then customize the interface of the workflow platform accordingly. An insurance process can only become successful if built as per the users’ requirements and functions seamlessly.

6. Enhance the client experience

Onboarding and claims processing can really put the customer experience to the test. The verification process is austere. However, the onboarding process can be speeded up by decreasing dependency on paper. The consumers of today are digitally aware and seek easy sign-up procedures no matter they are purchasing low-cost insurance or a corporate insurance plan.

A complete automotive insurance enterprise solution comprises complete information, automatically packaged papers for a specific claim, and automatically assigning claims.

Conclusion

The correct approach may depend upon the stage on which your business currently is on its transformational journey. Insurers must keep their expectations clear from the digital transformation initiative and pursue a systematic approach to extract maximum value.

Today, we are witnessing new partnerships forging between insurance companies and third-party vendors in order to reach higher operational efficiency in a seamless manner. With a complete understanding of insurance operations and a significant amount of experience in process transformation, these external vendors can lead to swift success in operational areas.

Need help to set things in motion?

Cogneesol delivers industry and functional solutions to insurers worldwide. With serving over hundreds of satisfied clients since its establishment in 2008, Cogneesol focuses on extending a wide range of value-added insurance business process management services to increase the efficiency of your business processes, cut down operational costs, and give you ample time to concentrate on customer acquisition retention and growth.

For insurance bpo services, call us at +1 646-688-2821 or email at [email protected].

Latest Blogs

This site is protected by reCAPTCHA. Google's Privacy Policy

and Terms of Service apply.