1000+

customers

50+ countries

across the world

Outsourcing leader

since 2008

Technology-driven

services

Stringent

quality processes

How Outsourcing Firms Assist Insurance Companies with Policy Renewal Services?

Last updated: 08 Sep, 2023 By Mohit Sharma | 6 Minutes Read

Insurers throughout the world handle a plethora of insurance policies on a regular basis. From new policies to renewal requests, there is a lot to manage for insurers. As an insurance business grows, the insurance company is able to acquire and retain clients more. Now, these retained clients apply for policy renewals, and insurers need to be very cautious with their requests.

The reason being such prestigious clients need to be handled with the utmost care, and their requests should be addressed efficiently and timely. However, with so many renewal requests to attend at the same time, it becomes overwhelming for insurers to handle all the related paperwork. This is where an outsourcing provider of insurance renewal services steps in and provides the much-needed support to the insurers.

Insurance Policy Renewal Process Requirements

1. Specialists

When dealing with the renewal paperwork of existing clients, there is no scope of error. Insurers need to be very careful while going through all the associated paperwork. So, it is vital to have specialists to take care of multiple terms and conditions of a policy renewal request.

It is a lot challenging to find the right talent having the required expertise, and almost every insurer can relate to this. During growth and scalability, this search simply amplifies, making things difficult for insurers to manage.

2. Time and Efforts

The insurance policy renewal process is a labor-intensive one and demands a lot of time and effort from insurers. Going through thousands of insurance policy pages manually and editing the same is a huge challenge in itself. When insurers allocate most of their valuable resources to manage such back-office tasks, they deprive themselves of the growth opportunities that could have been created with the same time and efforts.

3. Accuracy

Just as we discussed above, with so many policies to handle at the same time, it is natural for insurers to commit mistakes, especially when handling the processes manually. However, data integrity and accuracy cannot be put at stake at any cost due to human failure in either ensuring data accuracy or being able to identify discrepancies in the policy values.

4. Technology Investment

With customers becoming demanding more than ever, it puts direct pressure on insurers to serve them timely and proficiently. This is only possible when they replace manual policy renewal tasks with automation. So, in a way, investing in technology has become a necessity for insurers and is not considered an option anymore.

Also, investing in cutting-edge infrastructure and technologies puts insurers ahead of their competition. Although budget is a major issue for most of the insurers but for ones who can afford and buy, the problem persists when they realize their in-house members do not have the expertise/training required to handle technology appropriately, impacting their ROI directly.

5. 100% Compliance

The government regulations are always changing on a minor or major scale, and most of the insurance owners do not have time to keep a tap on the same regularly. Apart from this, evolving technologies and fluctuating market trends/financial conditions also demand complete compliance since it directly affects the image of the firm.

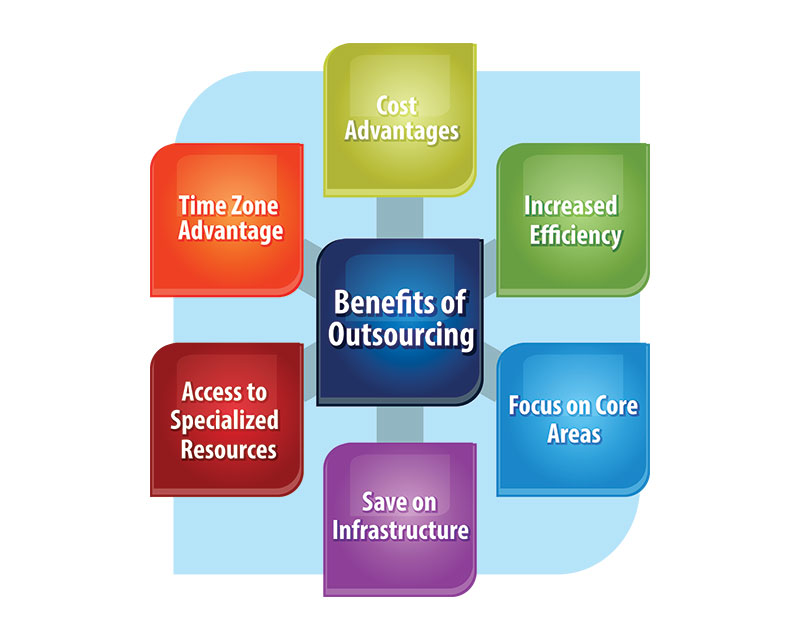

The Outsourcing Support Benefits

Highly Competent Team: A reputed and renowned outsourcing provider has a highly competent insurance back-office team. With at least 5 years of experience, relevant industry knowledge, and high technical skills, every member of the team is capable of handling, not just policy renewal but also other processes like policy issuance, checking, administration, and more.

Cost Savings:By joining hands with outsourcing providers, insurers are able to save on costs a lot. Usually, the outsourcing providers are from countries where high-quality back-office support is available at a much lower price as compared to the cost of hiring in-house professionals. This also saves them from providing additional benefits to in-house staff like health coverage, appraisals, etc.

Access to Latest Technologies: Outsourcing providers are highly competitive and advanced. They know their role and understand the need to incorporate the use of technology into their processes to serve clients quickly and efficiently. So, with outsourcing, insurers need not invest in costly technologies as they gain access to it effortlessly by collaborating with a top outsourcing provider.

Rapid Turnaround Time: Since outsourcing providers use the latest technologies to handle the policy renewal process, they are able to complete the tasks in a lesser time span. Automation simplifies and speeds up the manual tasks easily, leading to fast turnaround time.

Enhanced Focus on Core Competencies: Since your team is not wasting its time on managing back-office processes, it can focus on the core competencies. With outsourcing, insurers are able to free themselves and work on devising strategies for growth and scalability, including competitor analysis and understanding client demands.

Reduced/Zero Risks: Outsourcing providers ensure 100% compliance with the government rules and regulations concerning every policy type. They have a dedicated team for the same and take the responsibility of bearing every compliance risk. This restricts your business image from getting hampered due to any compliance issue; something which you would never want.

Conclusion

Undoubtedly, outsourcing comes with multiple benefits for insurers. In a time where insurance companies are highly competitive, business owners must invest their resources on acquiring and retaining clients and not on managing back-office tasks. Insurance outsourcing support enables insurers to achieve the same with reduced costs, high compliance rate, enhanced work quality, and more.

Are you searching for a trusted, renowned, and reliable outsourcing partner to manage your insurance renewal and other back-office processes? If yes, the team of Cogneesol is there to serve you. Contact us [email protected] or +1 646 688 2821 for a free trial!

Why Cogneesol?

Cogneesol, one of the leading business process outsourcing service providers globally, has been offering unmatched business to business services to insurers since 2008. We hold huge expertise when it comes to managing claims administration, loss run processing, policy checking/renewal, and more.

With 13+ years of industry experience, we know and understand the industry quality standards and have developed the required expertise and skills over the years to offer shorter turnaround times against our policy renewal services. We ensure your resources are redirected to business generating competencies while we handle your back-office burden cost-effectively, accurately, and proficiently.

Our Insurance Policy Renewal Services Include:

- Keeping track of insurance renewals in advance

- Sending out regular reminders to policyholders

- Taking requests for renewals from clients

- Evaluating all possibilities of risk in renewing a policy

- Creating detailed exposure summaries

- Communicating with insurance carriers regarding renewals

- Making sure the modifications (if any) are considered for revising the premium and more.

Recommended Post: Insurance Outsourcing: Business Continuity Plan for Insurers

Latest Blogs

This site is protected by reCAPTCHA. Google's Privacy Policy

and Terms of Service apply.