1000+

customers

50+ countries

across the world

Outsourcing leader

since 2008

Technology-driven

services

Stringent

quality processes

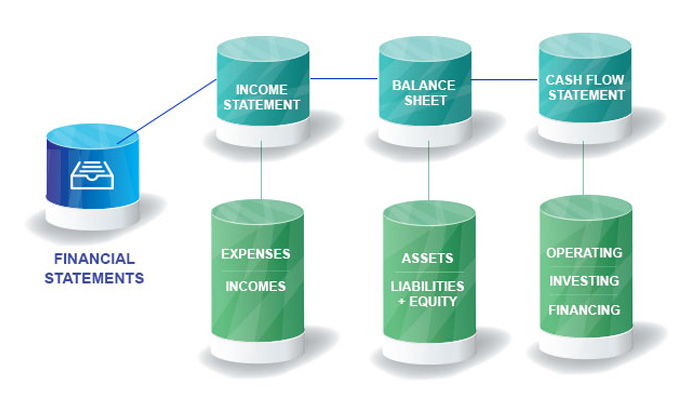

Financial Statements that are an Absolute Must for Your Business

Last updated: 25 Jan, 2024 By Admin | 6 Minutes Read

A smart business owner deliberately exerts time and effort to remain on top of his books. Whether or not you are a ‘numbers person’, getting a complete hold of your company’s financial situation is crucial. It helps to ensure cash flow of your business and excel in the dynamic market.

Exactly how do you begin tinkering with your business resources without setting your investment capital at stake? Comprehending the fundamentals of a financial statement is an excellent jumpstart.

Finance statements are records that reveal your monetary activities and present a projection of your cash flow. At the very least, your financial records additionally direct you in making advantageous business judgments.

Top 3 Financial Statements that you Should Keep Track of

Statement of spending budget

Typically known as the balance sheet, this kind of financial statement offers an extract of your SME’s resources, financial obligations, and shareholders’ collateral.

A balance sheet is important. It highlights the larger picture of what your business features, what it owes as well as % of your possessions and liabilities. All these factors are crucial to represent to your stakeholders.

Statement of all-inclusive income

Do you have any notion regarding the amount of money your business is practically minting? What about its deficits, have you learned about that also? The most convenient way to determine is to be informed about your statement of all-inclusive income, in any other case referred to as the income statement.

The key reason why it is essential: An income statement exhibits the outcomes of business procedures in a period of time simply by estimating your net profit.

Statement of cash flows

Have you been keeping tabs on the movement of capital in your company? You must. Determine where in your cash inflows are originating from and where it was used by checking your cash flow statement.

The key reason why it is essential: Your capacity to pay a loan is dependent upon the details reflected in your statement of cash flows. Cash flow records offer a traditional track record on the income generation and investing routines of your company. It is crucial any time seeking a financial loan or teaming up with investors.

As soon as you get the hang of financial statements, it is possible to work together more readily with an accounts outsourcing company. They’ll carry out just about all the number crunching whilst you look closely at your actual business functions.

Hire Cogneesol as your Accounting Outsourcing Partner

Are you aware that deciding to outsource finance and accounting outsourcing services provides your company a far more edge over your competitors? Learn more by fixing a consultation with our competent experts at Cogneesol.

Latest Blogs

This site is protected by reCAPTCHA. Google's Privacy Policy

and Terms of Service apply.