1000+

customers

50+ countries

across the world

Outsourcing leader

since 2008

Technology-driven

services

Stringent

quality processes

Want to Add Value to Your CPA Firm? Accounting Outsourcing Can Help!

Last updated: 18 Jan, 2024 By Ashish Rana | 6 Minutes Read

Over the last few years, the finance and accounting sector has been through a series of drastic changes, for example, legislations are becoming more stringent and necessitating governmental compliance and thorough transparency. CPA firms typically spend 70% of their time on low-margin, data-intensive compliance tasks. But, some studies also show accounting outsourcing helps save time – 80% of CAS clients say they have more time to focus on their business. Similarly, CPA firms can also save time and unlock several other business growth opportunities with the support of a good outsourcing company specializing in CPA accounting services. However, before we learn how accounting outsourcing can add value to your CPA firm, it is important to know why you need it.

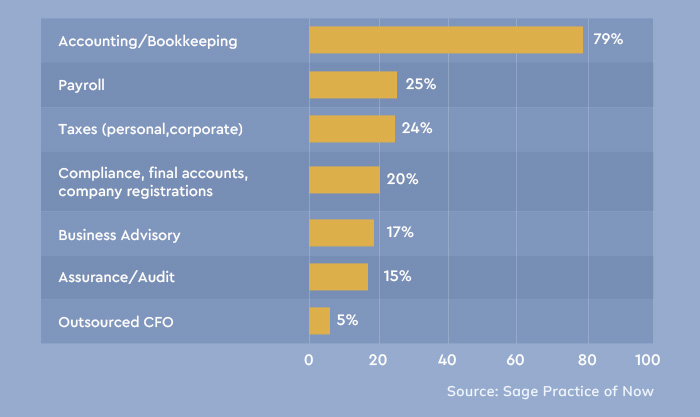

Top Services Offered by Accounting Firms

Reasons Why CPA Firms Outsource Bookkeeping & Accounting

Digital adoption is fast reaching almost every corner of the world with an increasing number of fintech companies building some of the best solutions for accounting businesses. This is resulting in the growing competition in the industry, putting pressure on CPA firms to ensure high-quality services with consistent delivery across the broad spectrum of clients’ accounting needs.

Not only that, but they also need to keep rates competitive and embrace flexible work schedules to meet client demands that are cautiously changing and growing.

Due to all these and other associated factors, CPA firms usually take on additional projects, which increase their workload while they also need to tackle low resource capacity. Consequently, they experience a reduced ability to manage manual, time-consuming, labor-intensive tasks, for example, bookkeeping, audit, risk management, compliance, etc., ultimately leading to less productivity. These are some of the most common reasons why many CPA firms prefer outsource accounting and bookkeeping services. Let’s now get further and check a few facts shedding more light on outsourcing for CPA firms.

How Does Accounting Outsourcing Add Value to Your CPA Firm?

Reducing OPEX

Ever since the concept of outsourcing exists, cost-saving has been on top of its benefits. Business owners usually outsource aiming to save costs and the same goes for accounting and CPA firms too. The right outsourced team can provide excellent services at affordable prices, helping you save up to 50% of the accounting and bookkeeping costs.

Cost-saving is a significant benefit of accounting outsourcing that allows you to reduce OPEX without losing efficiency, adding to financial reserves. In the current times when economic uncertainty is arising various challenges, outsourcing accounting can help you deal with challenging finance management issues.

Real-time Financial Data Accessibility

If your clients use online accounting software, you can help them maximize the same with the support of a good accounting outsourcing firm. Cloud accounting software enables accounting professionals to gain access to financial data in real-time. In addition, clients will be more than happy to have their financial information ready to access in real time.

As a transaction is updated as soon as it occurs, your staff can get helpful insights, detect inconsistencies, and rectify them well in time, before the data proceeds further and make false reports. In case you are running short on resources for software accounting services, outsourcing can be the best way to deal with this problem.

Take Advantage of Scalability Without Hefty Investment

CPA firms often seek highly-experienced experts to deliver more, specialized services to clients; however, they often face challenges with high hiring and onboarding costs. The situation even becomes worse when the peak busy season arrives. Outsourcing, which allows you to access skilled accounting specialists on demand, comes as a smart solution.

Since outsourcing firms charge comparatively low for the services they provide, you can scale staff easily without any additional costs such as – monthly salaries, health benefits, perks, and bonuses. Not only that, if your clients ask for some services that are currently not in your portfolio, you can simply take on that request and outsource those to your partner – a win-win situation for all.

Industry Best Accounting Practices

Depending upon the experience, accounting outsourcing firms have been helping CPAs and CPA firms for years. They know which practices have worked in the past and which have not. Which accounting standards should be suitable for which type of business.

With outsource accounting services, you gain access to experts who will help you embrace best accounting practices for the betterment of both your clients and the firm. An experienced and trusted outsourcing firm can help you establish an accounting model that will help you and your clients save time, money, ensure compliance, and add value.

Increase Efficiency & Productivity

Outsourcing some of most accounting back-office tasks to an external firm, you would realize your in-house team gets more time. You can devote them to key aspects of accounting that need undivided attention for a long.

As they get free from tedious and time-consuming repetitive accounting chores, you can experience a rise in their efficiency and productivity, all while having them focus on crucial business areas. Besides that, they get more time to learn, explore, gain new skills, etc. – all that will add value to your firm’s bottom line.

Let’s now look at some interesting facts on how accounting outsourcing helps accounting businesses.

Bill.com and CPA.com jointly conducted a survey in which 1,700 professionals participated. These professionals have employed client accounting services and they were asked to share how these services benefit their business. The results are mentioned below.

- 80% of the respondents said outsourced accounting services helped them save more time to focus on their business.

- 68% said their outsourced accounting firm help them implement best practices that made their accounting easier.

- 28% of respondents reported that their outsourced accountants’ advice helped them increase profits.

Conclusion

The benefits of outsourcing accounting services for CPA firms are not limited to the above-discussed. And a lot depends upon who do you choose as your outsourcing partner. The accounting outsourcing market is broad incorporating different types of firms you can partner with. However, you should know that you can only realize these benefits with the support of a reliable firm like Cogneesol.

We are a globally trusted accounting outsourcing firm serving clients across the globe since 2008. We provide well-built customized accounting solutions to CPA firms, helping them streamline accounting processes, clear backlogs, and maximize the process. In return, our clients gain higher capacity, efficiency, and productivity, adding value to their overall business. To learn about accounting outsourcing services and how we can help your firm, send an email to [email protected] or call us at +1 833-313-3143.

Read Also: Why CPA Firms Should Outsource Tax Preparation – 6 Strategic Reasons

Latest Blogs

This site is protected by reCAPTCHA. Google's Privacy Policy

and Terms of Service apply.