1000+

customers

50+ countries

across the world

Outsourcing leader

since 2008

Technology-driven

services

Stringent

quality processes

Keys to Business Success: Hiring the Right People for Finance Management

Last updated: 13 Oct, 2023 By Ashish Rana | 6 Minutes Read

To run a business successfully, it is critically important to have the right people work for you. Whether your employees are in customer-facing designations or handle back-office operations, you must ensure they meet your expectations. However, hiring the right people is not at all easy as there’s a lot at stake.

The estimated cost of a bad hire is around 30% of an employee’s annual compensation, according to the U.S. Department of Labor.

Effective financial management plays a crucial role in a business’s survival and success. Thus, there is no room for bad hiring for finance management. You must employ an expert (or a team of experts) who can efficiently plan, organize, control, and monitor your financial resources, helping you achieve your financial goals.

Going further, let’s read some tips from industry experts on how you should hire financial management staff for your business success:

Hiring the Right People for Finance Management

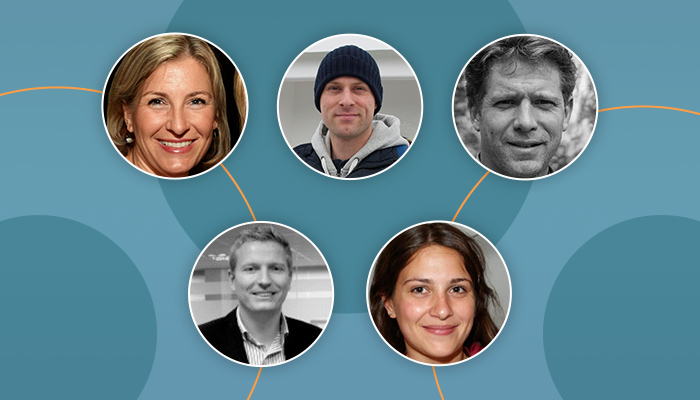

1. Richard Waters, Founder & Managing Director at Row

Having a reliable team for financial management is crucial for every business. They should be knowledgeable of different strategies to make the most out of the company’s budget. When this part of a company or organization fails, it may lead to bankruptcy or, if not, a huge loss.

You must scan through the best candidates when hiring your finance team. The leader must have experience or at least the will to learn the ropes of the trade. They must be trustworthy as well since there have been cases where company and organization budgets have been lacking because of dishonesty and stealing from someone in the finance team.

2. April Maccario, Founder at AskApril

In every business, the proper handling of funds is the key to success, and this is where the crucial role of financial management people comes to play. As a business owner myself, there is little to no room for error in handling and allocating your funds because a little mistake can impact the whole expense of the entire business. That’s why I hired an employee who is in charge of managing our finances because I don’t want to repeat the mistakes that I have made in the past.

3. Sonya Schwartz, the Founder of Her Norm

As a website founder, I also manage a small group of writers and outsource some help to run my business. After finding and trying different outsource companies to manage the finance department, I finally found someone whom I can trust. I have been very particular with this because it is my income and other budget matters that we talk about, and it is not easy to find people who you can trust that will do their very best to be honest and do things properly. Here are some of the qualifications that I took into consideration:

- I made sure that I have their background checked before having transactions with them. It is best if they come with a clean slate in the internet world because it means they haven’t faced any problems in the past.

- I also considered the timeframe of how long they can do the reports and settle everything without hassle.

- I also observe their work attitude and behavior along the way if they are easy and comfortable to work with.

4. David Walter, Small Business Owner at Electrician Mentor

Hiring the right financial management people to achieve business success involves knowing who you need to hire. For example, if you’re just starting out, you may want to hold off hiring at all, since you can probably handle the rather basic financial management practices of a budding small business. That said, once you start to grow and you find yourself spending an inordinate amount of time monitoring and managing the numbers (when you could be doing other more important things), you may want to hire a bookkeeper. That’s the first financial management hire for most businesses.

From there, if the job becomes too complex for just that one person, or if your tax situation gets a bit more difficult, then it would be time to bring on an accountant. That should suit you just fine until you find yourself having to deal with any of the following – investors, insurance issues, raising capital, and investments your business may make, among others. At that point, you would look to bring on a Chief Financial Officer. All three of these can play a huge role in the success of your business; just know which one you need and when.

5. Michael Humphreys Founder & CEO at Zgrills

Maintaining proper documentation of the financial record is the most crucial factor for all businesses. Like other small and medium businesses, we also face daily challenges in bookkeeping and accounting matters—one of the top bookkeeping issues we have faced in improper record-keeping. The issue occurred because we didn’t have the bandwidth, and our staff didn’t know which document to track. We solved this problem by tracking and staying organized. Using tools, receipt and invoice generation for the income that flew into our business became easy. We entered each info into our accounting system and kept a copy as confirmation.

6. Ostap Bosak, Manager at Marquis Gardens

It is important to look for three main traits when you are looking for the Financial Manager to bring you to success:

- Financial acumen. This one is kind of obvious, but you are looking for someone who can grow the excess cash flow and/or able to find the most efficient and cheaper sources of cash when needed. Whichever applicable to your business situation.

- Trustworthiness. As much as your accountant, this is the person who will know and have access to the most important resource of your business – money. Consider non-disclosure and non-compete clauses in the employment contract.

- Tax acumen. A good financial manager should be aware of major tax implications of money management. For example, in Canada, if over $50,000 of the corporation’s income is derived from investments, it might negatively impact the income tax bracket the company enjoys.

The Bottom Line

Considering these tips, we hope you will be able to hire the right people for your business. And once you do so, it is important to nurture the relationship between you (as an employer) and your employees. Share what vision you have for your business’s success and help them understand how their individual efforts add value to your overall business strength.

At Cogneesol, we have a team of skilled and experienced finance and accounting experts who can help you handle your finances and financial information effectively. We have been providing high-quality services to businesses and CPA firms worldwide since 2008. To learn more about our CPA bookkeeping services and financial accounting services, call us at +1 833-313-3143 or email [email protected].

Latest Blogs

This site is protected by reCAPTCHA. Google's Privacy Policy

and Terms of Service apply.