1000+

customers

50+ countries

across the world

Outsourcing leader

since 2008

Technology-driven

services

Stringent

quality processes

Roundups: What Services CPA Firms Usually Outsource and Why?

Last updated: 09 Oct, 2023 By Alika Cooper | 6 Minutes Read

It requires a lot of effort to manage and build a robust internal accounting team, which is capable of implementing best practices for your CPA firm. CPA firms are one of the busiest businesses today as, without their professional expertise, one cannot perform accounting/bookkeeping functions, handle financial reporting along with filing taxes.

However, dealing with so many clients and providing quality services becomes challenging for CPAs, which leads to multiple errors. That’s the reason many CPAs are outsourcing accounting functions to third-party vendors in order to alleviate their burden and focus on core activities.

Do you know which are the common accounting tasks outsourced by CPAs? This is what top CPA firms have to say:

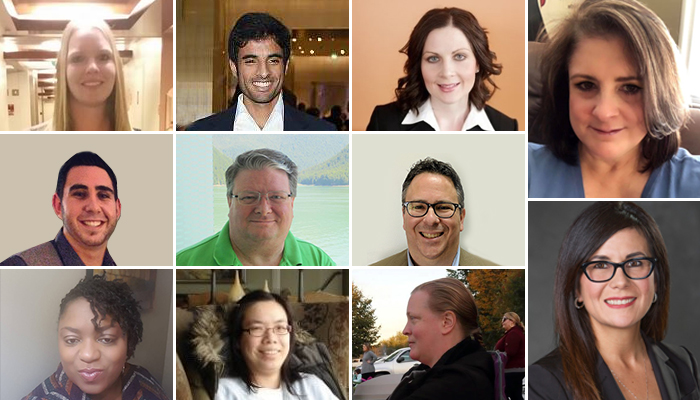

1. Rebecca Waller

Chairwoman at Ouija Board of Directors and works at Accounting/business course tutor at McNeese State

I think Payroll is the service which is most often outsourced followed by Tax and Human resource service. Payroll is a chore, which is time-consuming, time-sensitive, and requires strict reporting. Regarding Taxes, I think they don’t employ an in-house tax specialist and the same goes for HR, eventually leading to outsourcing.

2. Alicia Rogers

Owner at Alicias Financial Services & Bookkeeping

It all depends on the firms and their specialty. Some CPAs only want to handle taxes, and they outsource bookkeeping. Some outsource payroll and do the bookkeeping. Some do it all. It varies greatly by the firm type.

3. April Thiel

CPA Treasurer Board of Directors, CPA and Senior Tax Manager

Payroll is the number one outsourced service. There are many nuances to payroll and a payroll outsourcing company can concentrate on the same for our clients. We work closely with many payroll outsourcing companies and work hard to recommend the right fit for a client’s specific needs.

4. Fahad Syed

Ex-auditor at KPMG

I am an ex-auditor with KPMG, and they don’t outsource anything from the outside but rather utilize their network and brand name for seasonal demands.

For example, year-end auditors are too busy, so they get seconded auditors from the Asian country. KPMG branches to be placed at a much lower cost and to calm waters during year-end audits. So, it is audit outsourcing. Isn’t it?

5. Flora Teoh

Senior Accountant at Lilly C.P. Chen, Ltd.

It really depends. Anything can be outsourced from bookkeeping (a time-consuming task that does not pay well) to assurance services (these include a lot of work and the pay is not that great either. Many practitioners of smaller firms prefer to just deal with notice to readers, tax consulting and work in more complex and/or specialized areas.

6. Angela Weber

CPA at Weber

I get a lot of solicitation to outsource my client’s bookkeeping. I prefer to keep it at my firm. Ideally, this work was done by my firm’s bookkeeper. So, it is bookkeeping.

7. Sterling Varon

District Manager at ADP

Usually payroll! I work with many firms who outsource payroll to me because payroll usually brings on more unwanted liability to the firm.

8. Linda Michalek

Works at O’Connor & O’Connor, CPAs

PAYROLL!!! Honestly, it’s a pain to keep up with different states, which needs dissimilar forms, dbl, workers comp, and clients aren’t always upfront about items deductible from Federal Taxable Wages. Eventually, leading to outsourcing as dealing with it is quite a pain.

9. Tom O’Connor

Former Owner at Thomas A. O’Connor, CPA LLC

Bookkeeping! I’m sure many want to concentrate on tax, management advisory, and financial planning. Better to outsource it than struggle with time management, meeting client’s requirements, and negotiating prices for the solutions offered.

10. Bob Swetz

Owner at Home Business Online w/Bob Swetz, CPA

I would say probably the number one thing that firms outsource is payroll. I suppose it’s because payroll can be a tedious process depending on the size of your staff. So, it can be a good decision to outsource because it is a big time saver.

11. Shanita Jones

CEO at Jones Taxes & Financial Services, LLC

Marketing and payroll are the only two I outsource regularly. If I was in a crunch, I might outsource other things as needed but definitely those two. Other firms majorly outsource bookkeeping.

Conclusion

It clearly means that maximum CPAs prefer to outsource payroll and accounting tasks as they are time-consuming and labor-intensive. So, simplify your accounting processes with a reliable and efficient firm like Cogneesol. Get in touch with us today at +1 833-313-3143 or email us at [email protected].

Read Also:

Want to Add Value to Your CPA Firm? Accounting Outsourcing Can Help!

Accounting Outsourcing: How is it ideal for CPA Firms? [Infographic]

Latest Blogs

This site is protected by reCAPTCHA. Google's Privacy Policy

and Terms of Service apply.