1000+

customers

50+ countries

across the world

Outsourcing leader

since 2008

Technology-driven

services

Stringent

quality processes

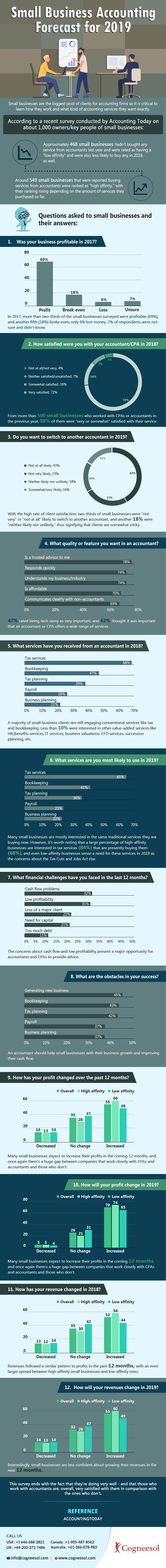

Small Business Accounting Forecast for 2019 – Infographic

Last updated: 23 Nov, 2023 By Harinder Pal Singh | 6 Minutes Read

Recognizing the significance of accounting is a universal understanding among businesses, regardless of their size. However, not every firm opts to hire accountants and CPAs for small business forecasting.

Many small and medium-sized enterprises believe they can manage tax and bookkeeping tasks independently. However, what they may overlook is that, despite their efforts, they might not match the expertise of a Certified Public Accountant (CPA).

Attempting to handle these critical financial tasks without the necessary business accounting expertise increases the likelihood of mistakes, leading to financial management failures and negatively impacting overall business productivity. Furthermore, businesses following this approach struggle to allocate their full-time efforts toward business growth. Small business forecasting can help you achieve your goals in the long run.

Contrastingly, over 70% of SMB businesses choose to hire accountants and CPAs, experiencing significant business growth as a result. The key lies in their ability to focus solely on developing business strategies and enhancing service quality, while accounting professionals expertly handle all financial tasks.

This strategic approach allows businesses to thrive, leveraging the expertise of accounting professionals to navigate financial intricacies. As a result, they not only avoid critical mistakes but also ensure that their business operations run smoothly, fostering sustained growth and success.

Small Business Forecasting that you Should Know

Latest Blogs

This site is protected by reCAPTCHA. Google's Privacy Policy

and Terms of Service apply.