1000+

customers

50+ countries

across the world

Outsourcing leader

since 2008

Technology-driven

services

Stringent

quality processes

QuickBooks vs FreshBooks: Best Accounting Software for Businesses

Last updated: 06 Sep, 2023 By Harinder Pal Singh | 6 Minutes Read

In the new business era, most organizations are looking for advanced accounting software to streamline business accounting and finance management via simplified invoice processing, cash flow management, payroll management, financial reporting, etc.

If we discuss the accounting software landscape, there are various applications available in the market; however, this article will cover a detailed comparison of two of the most widely used accounting tools. FreshBooks accounting software is one of the popular accounting software developed while keeping in mind the needs of SMBs. Another popular one is QuickBooks accounting software which is used by businesses of almost all sizes.

While the two software are loaded with various helpful features, it is essential to compare them in order to select one for your business. Therefore, here’s a detailed comparison of both, but before that, let’s look at some important facts about both.

Facts and stats about both software’s usage across industries and countries

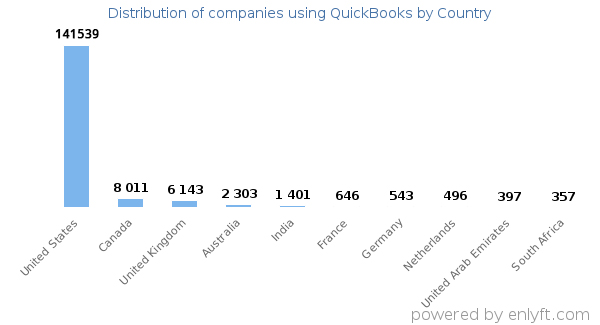

With 82% of QuickBooks users in the US, here are the top countries that use QuickBooks:

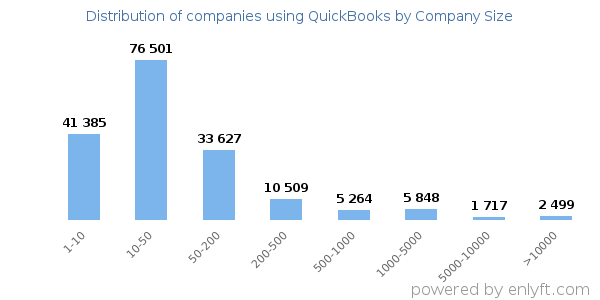

QuickBooks users (companies) based on their size (number of employees):

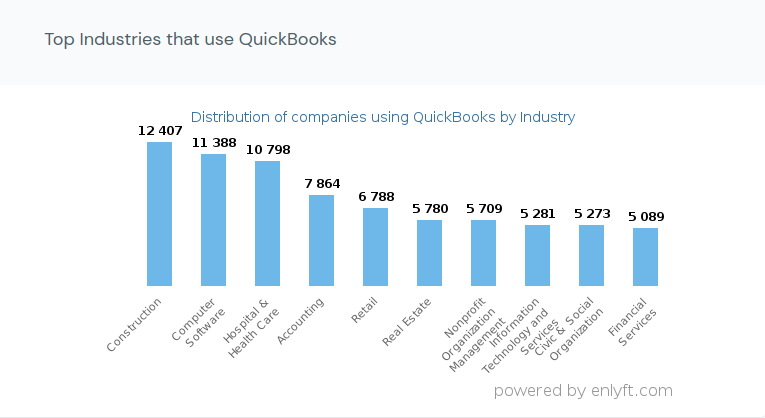

QuickBooks usage across industries:

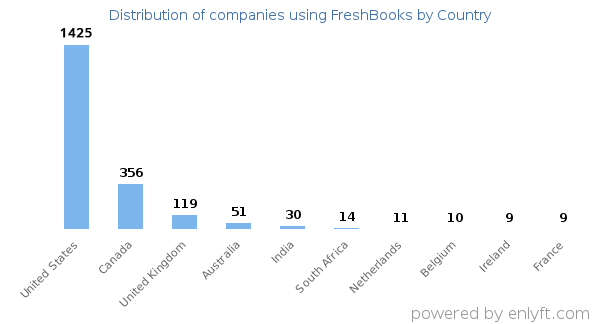

With 60% of FreshBooks users in the US, here are the top countries that use QuickBooks:

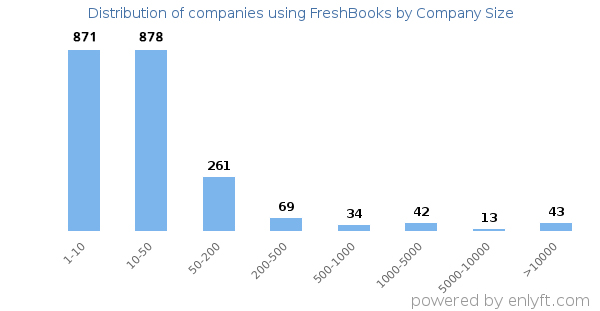

FreshBooks users (companies) based on their size (number of employees):

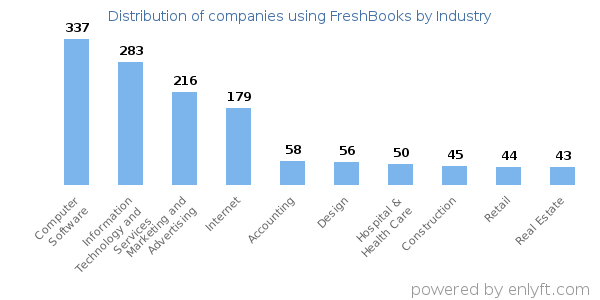

FreshBooks usage across industries:

Rating Comparison

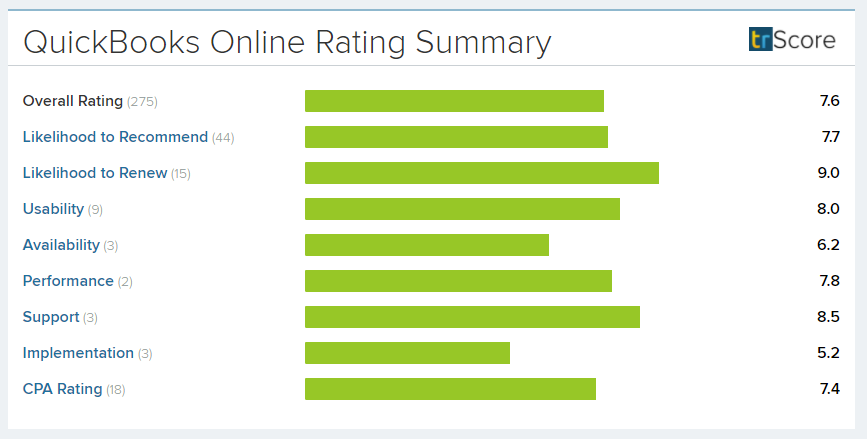

Check the rating given to QuickBooks Online based on various factors:

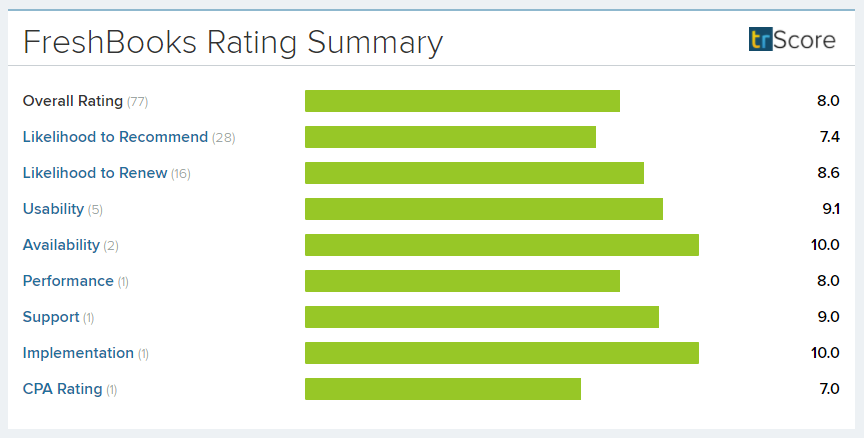

Check the rating given to FreshBooks based on various factors:

Pricing Comparison

Both software offer flexible and affordable pricing plans that business owners like you can choose according to needs and budgets.

Pricing plans for QuickBooks:

- Simple Start – $12.50 per month

- Essentials – $25 per month

- Plus – $40 per month

- Advanced – $90 per month

Pricing plans for FreshBooks:

- Lite – $6 per month

- Plus – $10 per month

- Premium – $20 per month

- Custom – you can obtain pricing details for this plan by calling FreshBooks’s sales team

Detailed comparison of features offered by FreshBooks and QuickBooks accounting software

1. Expense Tracking

Expense tracking plays an integral role in preparing budgets and managing the finances of any business. Users have shared that FreshBooks offers an expense tracking feature to help you view your business expenses and profits on a single platform.

QuickBooks allows you to connect your business checking accounts and credit cards to the software and app, importing, categorizing, and tracking all your expenses automatically.

Both software offer unlimited tracking of expenses with all plans.

2. Time Tracking

FreshBooks brings along this built-in feature. It is excellent for businesses that operate on a case- or project basis, for example, law businesses, construction companies, professional services firms, etc. It makes it easier for employees to track billable hours and view the big picture of projects on the dashboard, enabling you to ensure your staff satisfies all working hours requirements.

On the other hand, QuickBooks offers this as an additional accounting feature that monitors work time and payroll for part-time and full-time employees. In the absence of this add-on feature, payroll can be entered as an expense and billed via categorizing employees’ services as products.

3. Invoicing

The invoicing feature comes with FreshBooks’ plan in terms of cost, even the least expensive one costs $7.50 per month. It allows you to create and send as many invoices as you need to and automate recurring invoicing. Also, with payment reminders to clients and multiple payment options, your clients can process payments in an easy and quick manner.

Similarly, QuickBooks offers the invoicing feature with its all plans that allows you to generate and send invoices, accept payments via bank transfers and credit cards, set up automatic payment reminders, and automatically reconcile payments received with the amounts described in the invoices.

4. Payroll Management

FreshBooks does not have payroll management tools but is compatible to be integrated with other payroll software such as Gusto. However, since Gusto is third-party payroll software, you will need to pay an additional fee to use it with FreshBooks.

Payroll comes as an add-on feature with QuickBooks, which you can use by paying extra, ranging from $22.50 to $62.50 per month, in addition to a fixed amount ($4 to $10) per employee per month.

5. Reports

QuickBooks allows you to generate various types of statements and reports, delivering valuable insights you need for analytics purposes to make better business decisions. However, you may need to enter data and add tags manually; therefore, you must keep detailed, accurate financial records if you want to make full use of the software’s capabilities.

On the contrary, FreshBooks mainly provides reports on profit margins. The main dashboard of FreshBooks delivers advanced features: financial input vs. output for a certain period. Since it works best for tracking time and handling invoicing, the reports it can generate will be about payment collection and taxes.

6. Project Profitability Report

Using QuickBooks, you can track how much profits you are earning from a project, getting detailed information on labor costs, other costs, payroll, job costing, etc. You need to opt for the ‘Plus’ or ‘Advanced’ plan to use this feature. However, you need to avoid some common mistakes in QuickBooks accounting software to leverage it to its full potential.

FreshBooks also offers the same feature along with a graph that helps you better understand your total costs, income, and profit. This feature comes with the ‘Premium’ plan, and you can add it as per your need in a custom plan.

7. Inventory Tracking & Management

QuickBooks’ track Inventory’ feature allows you to track and maintain records of payments made for supplies and current inventory and use this data to manage inventory effectively. This feature can be best used by SMBs in the manufacturing and retail industries that often include complicated accounting processes.

FreshBooks does not offer any features for inventory tracking and management.

8. Tax Calculations

Tax preparation is no more a challenging process. With QuickBooks, you can upload scanned copies of your receipts, which you can record and save so that you can use this data at tax time and save by applying for tax deductions. In addition, it can give you an estimate of quarterly taxes applicable to your business, and you can use this feature even with the plan that costs the least.

FreshBooks allows you to track use taxes and provides tax reports.

Which one’s best for you?

You may choose FreshBooks if you;

- Have just started a new business

- Work as a freelancer

- Need a user-friendly accounting software

- Need integration capabilities

You may choose QuickBooks if you;

- Sell products

- Are looking for scalable accounting solutions?

- Want to leverage more features than FreshBooks

- Need a one-platform for your accounting and invoicing requirements

- Are running a medium-sized business?

How can Cogneesol help businesses with QuickBooks & FreshBooks Accounting?

With a pool of software accounting experts, Cogneesol helps businesses utilize their QuickBooks or FreshBooks software at its best. We have been providing quality QuickBooks accounting services to businesses across the globe since 2008, ensuring our clients regain control over financials, increase transparency, optimize resources, streamline processes, and save on costs. To reap all such benefits, you may choose Cogneesol for software accounting services.

Learn more about our services and pricing plans; dial +1 833-313-3143 or send an email to [email protected].

Also Read: Best Ways to Avoid Making a Mess in Quickbooks Online

QuickBooks Business Accounting Software Versions and Prices – The Comparison

Latest Blogs

This site is protected by reCAPTCHA. Google's Privacy Policy

and Terms of Service apply.