1000+

customers

50+ countries

across the world

Outsourcing leader

since 2008

Technology-driven

services

Stringent

quality processes

COVID-19 Outbreak: Are Insurance Companies Ready to Respond?

Last updated: 15 Apr, 2024 By Mohit Sharma | 6 Minutes Read

Observations are indicating that the virus – COVID-19 has been spreading westwards, as starting from the Central Asian country – China in late 2019, reaching European countries in the first quarter of 2020. And by this time, it has spread across North America, killing more than 83,082 people. Amid all this, insurance companies response is pretty much depending upon their geographical location.

In Asia, insurers responded quickly to the crisis and are now about to begin an assessment of the industry to anticipate where the situation for the insurance market can lead to and what might be the possible impacts of this outbreak in the long run.

However, insurers in some countries of Europe and North America are still under immense pressure to cope with staff shortage, managing insurance back-office workload, and trying their best to tackle a lot of other challenges arisen due to the consequences of the deadly coronavirus.

Since the crisis began, insurance carriers have lost almost 48% of their market value while specifically life and health insurance carriers experienced an average drop of 58%. The cost of tests and treatment of COVID-19 is likely to take away a considerable portion of health insurers’ profits across the U.S., and to cover these costs, they might consider increasing premiums soon.

The current situation will have many more repercussions and compel insurers to make a lot of changes in their business models in the years to come. For now, let’s discuss some of the emerging business risks in the insurance sector and find out if insurers are ready for them.

Challenges Insurers Facing Worldwide Amid COVID-19

Insurance companies are surrounded by several problems arising at the same time.

Sinking Investment Portfolios

As mentioned above, insurers have lost significant market value due to uncertainties in markets; this may have a negative impact on their investment portfolios, especially when everyone is clueless about what would happen next. This will be a big problem for insurers relying on their investment portfolios in order to generate returns. Besides, as interest rates are going downwards, there may be fewer income revenues from interest.

Diminishing Demand

As many businesses around the globe are operating partially while some are entirely closed, millions of people have lost their jobs. Adding to that, social distancing and lockdown are big reasons people are not buying insurable purchases such as houses, motor vehicles, personal computers, etc. The decrease in demand for insurance is leading to a decline in insurers’ income.

Imbalanced Cash Flow

Similarly, as many policyholders have become unemployed, they have limited or no money for their survival. As a result, insurance companies are urged by regulatory agencies to allow customers some time to make payments that also without late-payment fees. This is hampering insurance companies’ cash flow. And amidst all this, they are bound to pay out claims.

Disputes over coverage

Insurance policies generally don’t cover pandemics, and thus, necessary charges to cover pandemics are not included in premiums. However, some states are enacting laws to make insurance companies obliged to compensate for business loss and interruption owing to the COVID-19 outbreak. This is resulting in deciding which party is liable to pay the additional costs to cover these losses.

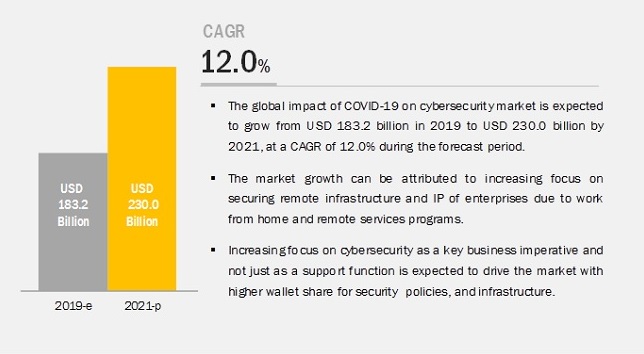

Cyber risks

As effective management of claims processing tasks is the top priority, many insurance companies have already followed work-from-home to process claims uninterruptedly; while practicing social distancing to prevent the coronavirus from spreading. But, it has brought another business risk into consideration – cyberattack. No doubt, the insurance industry has been taking appropriate steps to secure their systems (and the sensitive information they hold) against cybercrime for several years, it is a crucial time to take additional steps ensuring employees are connecting through highly secure remote networks.

How are insurers responding to the COVID-19 crisis?

Insurers’ response to the current crisis will vary with how strong their operational and technological grounds are. It is expected to experience inefficiency and interruption in processes and systems due to heavy loads of work, primarily including customer queries and claim forms. Many insurance carriers have already issued statements informing customers that they might experience service disruption and longer wait time to connect with customer care executives because of staff shortage.

Companies worldwide have been adopting the concept of remote working to continue business operations and meet customer demands, which seems to be very useful. Besides, insurance business process outsourcing is also in trend amid the lockdown. Many are heading toward competent and reliable outsourcing companies to get the type of support they need for managing different processes.

Insurers that take a proactive and empathetic approach for customer engagement and service are more likely to tackle the crisis and achieve high customer retention rates when things go calm. For example,

- Health and safety advice

- Satisfactory coverage

- 24×7 availability across all channels

- Use of data and analytics

- Predictive claims capabilities

- Automated payouts

- Skilled workforce

Insurance companies that have just begun their journey toward digital transformation can take the required support from outsourcing firms. Companies that remain proactive are in a better position. They stay updated with industry trends and seek advice from experts and professionals. This approach helps them effectively deal with the series of challenges that have arisen due to COVID-19.

What should insurers consider in post-pandemic time?

In the future, comprehensive business insurance or policies that can cover business interruption will be in high demand. Insurers will also need to focus on digital transformation. After the COVID-19 crisis comes to an end, insurers must put all required efforts to accelerate digital transformation by collaborating with reliable technology partners.

They can also consider outsourcing some of their back-office processes that take a lot of their staff’s time. And still don’t generate revenue, such as insurance accounting, policy checking, commission management, claims processing, etc.. By outsourcing, they will not only save time but also experience uninterrupted operational flow as outsourcing service providers usually operate 24 hours a day, 5 days a week.

The impact of COVID-19 has reached almost every place in this world, killing humans and disrupting business operations. Its most significant effect is – rapid reduction in the availability of human resources, which is leading to less efficiency and productivity. If you are also experiencing the same or similar to this, we are here to rescue you.

Contact Cogneesol – one of the leading insurance process outsourcing companies, serving insurers worldwide with excellence for more than 16 years now. We are offering a wide range of insurance back-office outsourcing services at affordable costs, even during the current crisis. Get in touch with us today to get a free quote. Call us at +1 646 688 2821 or email at [email protected].

Recommended Post-

The Digital World Propels Insurance Companies to Re-Evaluate Their Operations!

Latest Blogs

This site is protected by reCAPTCHA. Google's Privacy Policy

and Terms of Service apply.