1000+

customers

50+ countries

across the world

Outsourcing leader

since 2008

Technology-driven

services

Stringent

quality processes

Client Accounting Services – The Future of CPA Firms [INFOGRAPHIC]

Last updated: 12 Mar, 2024 By Ashish Rana | 6 Minutes Read

In recent years, the accounting industry has undergone technological advancements and introduced the concept of CAS (Client Accounting Services), which is becoming very popular amongst customers. The idea of CAS keeps customers at the heart of all accounting services, and hence, its implementation can help various accounting areas gain optimum customer satisfaction.

CAS includes providing the best possible accounting services to clients and helping them with financial business decisions. Although in a CAS model, you, as an accountant, pay heed to all the accounting needs of the clients, the approach should always be to maintain a win-win balance between the client requirements and your business growth.

Historical Overview of Traditional CPA Firm Services

Since their inception, Certified Public Accountant (CPA) firms have played a crucial role in providing a wide range of financial services to businesses and individuals alike. Traditionally, these firms have offered services such as tax preparation, auditing, and financial statement analysis. The historical evolution of CPA firm services reflects the changing needs of clients and the broader economic landscape.

In the early days, CPA firms primarily focused on tax compliance and assurance services, helping clients navigate complex tax laws and regulations while ensuring financial transparency and accountability. As businesses grew more complex and globalized, the demand for specialized services like forensic accounting and management consulting emerged, prompting CPA firms to expand their service offerings to meet these evolving needs.

Despite these advancements, the core principles of integrity, professionalism, and client service remain at the heart of every CPA firm.

Implementing Client Accounting Services in CPA Firms

Client Accounting Services (CAS) represent a significant shift in the way CPA firms deliver value to their clients. Traditionally, CPA firms focused primarily on compliance-driven services such as tax preparation and auditing. However, with the rise of technology and changing client expectations, there has been a growing demand for more proactive, strategic advisory services.

Implementing CAS within a CPA firm involves offering a comprehensive range of outsourced accounting and finance functions to clients, including bookkeeping, payroll processing, financial reporting, and budgeting. By taking on these day-to-day financial tasks, CPA firms can free up their clients’ time to focus on core business activities while providing valuable insights and strategic guidance based on real-time financial data.

To successfully implement CAS, CPA firms must invest in technology, talent, and training to ensure they have the necessary skills and expertise to deliver high-quality services. They must also communicate the value proposition of CAS to clients effectively and tailor their offerings to meet the unique needs of each client.

Let’s discuss Client Accounting Services in detail and get facts and stats about it:

CAS might include transactional services, strategic services, performance services, and compliance services

Client Accounting Services means that you, as an accountant, do most (if not all) of the accounting tasks for your clients. You perform:

- Bill payment, transaction processing, processing of AR, AP, and bookkeeping

- After-the-fact financial statement preparation (write-ups)

- Periodic tax payments/compliance (sales tax, etc.)

- Payroll and payroll compliance

- Outsourced CFO and/or controller services, reviewed financial performance and provided input on strategies to improve business

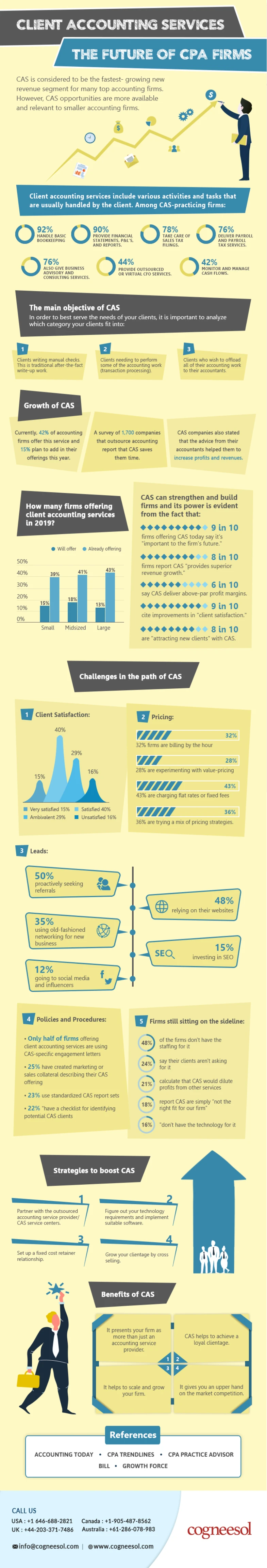

Client accounting services include various activities and tasks that are usually handled by the client. Among CAS-practicing firms:

- 92% handle basic bookkeeping

- 90% provide financial statements, P&L’s, and reports

- 78% take care of sales tax filings

- 76% deliver payroll and payroll tax services

- 76% also give business advisory and consulting services

- 71% do write-up

- 53% handle accounts payable and pay bills for clients

- 44% provide outsourced or virtual CFO services

- 42% monitor and manage cash flows

- 36% handle accounts receivable.

The main objective of CAS

The major objective of CAS is that each of your clients receives customized accounting practice that best serves their requirements and adds value to their business, while also maximizing the profit for your firm.

In order to best serve the needs of your clients, it is important to analyze which category your clients fit into:

- Clients writing manual checks. This is traditional after-the-fact write-up work.

- Clients need to perform some of the accounting work (transaction processing).

- Clients who wish to offload all of their accounting work to their accountants.

Growth of CAS

- A survey of 1,700 companies that outsource accounting report that CAS saves them time.

- CAS companies stated that the advice from their accountants helped them to increase profits and revenues.

During one survey done by Accounting Today, 800 accounting firms were asked – “will your firm offer client accounting services in 2019?”. As a result of the survey, 15% small size, 18% midsize, and 13% large size accounting firms said they will include CAS in their offerings and surprizingly, 39% small size, 41% midsize, and 43% large size accounting firms said they are already offering CAS.

CAS can strengthen and build firms and its power is evident from the fact that:

- 9 in 10 firms offering CAS today say it’s “important to the firm’s future.”

- 8 in 10 firms report CAS “provides superior revenue growth.”

- 6 in 10 say CAS delivers above-par profit margins.

- 9 in 10 cite improvements in “client satisfaction.”

- 8 in 10 are “attracting new clients” with CAS.

Challenges in the path of Client Accounting Services

-

Client Satisfaction:

Only about 15% of firms say they are “very satisfied” with the financial and operational performance of their client accounting services, and 40 percent are merely “satisfied.”

-

Pricing:

Many firms are trying a mix of strategies to sort out the pricing for new service lines.

- 32% of firms are billing by the hour,

- 28% are experimenting with value-pricing,

- 43% are charging flat rates or fixed fees, a

- 36% are trying a mix of pricing strategies.

-

Leads:

Customary marketing techniques are followed by many firms to develop CAS business.

- 50% – proactively seeking referrals

- 48% – relying on their websites

- 35% – using old-fashioned networking for new business

- 15% – investing in SEO

- 12% – going to social media and influencers

- 11% – developing content marketing and thought-leadership campaigns

- 8% – “assigned a specific person” to take the lead

-

Policies and Procedures:

There is a lag in the procedures and policies to support the expansion of CAS business.

- Only half of the firms offering client accounting services are using CAS-specific engagement letters

- 25% have created marketing or sales collateral describing their CAS offering

- 23% use standardized CAS report sets

- 22% “have a checklist for identifying potential CAS clients

-

Firms Still Sitting on the Sideline:

Many reasons drive the firms that are still sitting on the sideline against the adoption of CAS:

- 48% of the firms don’t have the staffing for it

- 24% say their clients aren’t asking for it

- 21% calculate that CAS would dilute profits from other services

- 18% report CAS are simply “not the right fit for our firm”

- 16% “don’t have the technology for it

Strategies to boost CAS

-

-

Leadership:

Someone at a significantly higher position needs to take the responsibility of implementing a CAS culture.

-

Partnership:

Partnering with the outsourced accounting services provider/ CAS service centers can help implement daily client accounting.

-

Technology:

Figure out your requirements and then implement suitable software in support of the same.

-

Fixed cost:

Set up a fixed cost retainer relationship that allows for a defined service plan.

-

Growing CAS client base:

Grow your clientage by cross-selling.

-

Training:

It is an important factor for successful implementation. Staff must be properly trained to implement CAS strategies.

-

Benefits of CAS

- It presents your firm as more than just an accounting service provider to your clients.

- CAS helps to gain the trust of your clients, and they depend on your firm for important business decisions. Hence, you achieve a loyal clientage.

- As you gain more clients, it becomes easier for you to scale your own business with outsourced accounting services and think about the growth of your firm.

- It helps build a longer-lasting business model for your firm going forward. It gives you an upper hand on the market competition and ensures you more sustainability.

For the CPAs, structuring the accounting firm of the future starts with an adequate change of mindset. The clients and prospects expect more from the accounting firms, and CAS provides that.

Client Accounting Services (CAS) involve outsourcing accounting and financial tasks to a trusted third-party provider, such as Cogneesol. These services encompass a range of financial activities, including bookkeeping, payroll processing, accounts receivable and payable management, financial reporting, and tax preparation.

Outsourcing accounting tasks to Cogneesol for CAS offers numerous benefits. Firstly, it allows businesses to access expert financial professionals without the overhead costs of hiring in-house staff. Cogneesol’s comprehensive CAS solutions ensure compliance with regulatory requirements, improve financial accuracy, and enhance decision-making capabilities.

Cogneesol’s CAS offerings cover a wide range of accounting tasks, including but not limited to:

- Bookkeeping and accounting entries

- Accounts receivable and accounts payable management

- Bank and credit card reconciliations

- Payroll processing and tax compliance

- Financial reporting and analysis

- Budgeting and forecasting

- Tax preparation and filing

When selecting a provider for CAS, businesses should consider factors such as:

• Experience and expertise in accounting and finance

• Reputation and client testimonials

• Compliance with industry regulations and standards

• Technology and security measures in place

• Customization and scalability of services

• Pricing and value proposition

Cogneesol excels in each of these areas, offering tailored CAS solutions designed to meet the unique needs of each client while ensuring data security and regulatory compliance.

A reputable CAS provider like Cogneesol stands out in the industry due to its:

• Proven track record of delivering high-quality accounting services

• Team of experienced and certified accounting professionals

• Commitment to client satisfaction and long-term partnerships

• Cutting-edge technology infrastructure for efficient service delivery

• Flexibility and scalability to adapt to evolving business needs

• Transparent pricing and value-added services

Latest Blogs

This site is protected by reCAPTCHA. Google's Privacy Policy

and Terms of Service apply.