1000+

customers

50+ countries

across the world

Outsourcing leader

since 2008

Technology-driven

services

Stringent

quality processes

Chart of Accounts in Xero – 5 Things You Should Know

Last updated: 20 Nov, 2023 By Ashish Rana | 6 Minutes Read

A chart of accounts (COA) is one of the components for financial organization, providing a complete and section-wise organized listing of all accounts in an accounting system. Balance Sheet accounts and Profit & Loss accounts are the two sections in a COA. Each section presents the names and unique numbers that help organizations to identify and record all financial transactions to proceed further in accounting.

Although it is not mandatory to have a deep understanding of accounting principles, some concepts should not be ignored. As financial bookkeeping principles are broad and difficult to understand, these days, some accounting applications, with different features, are helping accountants and business owners to reduce their accounting workload. Xero accounting software is among the most used accounting applications across the globe.

We will shortly discuss it in detail, but before that, you need to understand the importance of the Chart of Accounts.

Why is the Chart of Accounts Important?

The Charts of Accounts is often referred to as the ‘backbone’ of an organization’s financial records as it display a flow of all transactions and help to make reports. If your company’s COA is poorly prepared or if the transactions are inserted in the wrong sections, you will get inaccurate reports in your hands. In such a situation, you need to:

I. Create a Balance Sheet Statement

The balance sheet is a significant type of financial statement, which includes fixed assets such as property, vehicles, goodwill, stock, bank balances, and debtors (money owed to the organization). All these assets usually get depreciated with a time of more than one year. It also includes liabilities, which are generally the money the company owes to creditors, HP agreements, suppliers, and taxes.

Note: If transactions are not correctly categorized in the right section of COA, your income tax return will not match with the figure the IRS is expecting. Therefore, make use of balance sheets to apply for financing, to attract investors and prepare taxes accurately.

II. Create Profit and Loss Statement

The profit and loss account, often called the Income Statement, provides a snapshot of the expenses and incomes for a specific period. This further helps to determine if the organization is in profit or loss.

To calculate your company’s financial profit or loss, follow these simple steps:

- Make a total of your income for the month by adding them all.

- Similarly, make a total of your expenses for the month.

- Subtract total expenses from total income.

- The resulting amount is your profit or loss.

Note: The profit & loss statement helps you monitor your finances by providing you a clearer view of your expenses and income, and thus, you can easily analyze your company’s fiscal health to make business plans for the coming years.

Crucial Components of Chart of Accounts in Xero

In case of growing accounting issues, one might need to consider using Xero software which simplifies complex accounting processes. The software knows how to document transactions, which is essential to stay compliant with all the rules that CPAs and other organizations must follow. Xero accounting application is effectively helpful in maintaining finances and their reports.

About the charts of accounts in Xero, it is just another great feature in the software that you should know how to use. The COA in Xero includes individual accounts that further categorize the Assets, Revenue, Expenses, and Liabilities of an organization. Each account can have five major components, which are as follows:

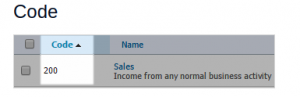

I. Code:

In your chart of accounts in Xero, each account will have a unique code. This code can be made up of 10 characters only. The prime motive of using codes is to make a group of accounts that are similar or frequently used.

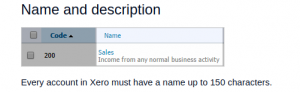

II. Name and Description:

Similar to the codes, each account in Xero will have a name and a brief description. While it is mandatory to give names to the accounts in not more than 150 characters, adding a description is optional. You can use numbers, letters, symbols to write a description of up to 1000 characters. Both the name and description are editable.

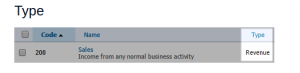

III. Type:

Each account should be categorized in the ‘type’ section for easier financial reporting. There are 5 categories for account types in Xero:

- Assets: Bank balance, current assets (e.g. cash and cash equivalents, money receivable, marketable securities), fixed assets (office furniture, machinery, building, vehicles such as company trucks), non-current assets (property, plant, and equipment), and prepayments.

- Liabilities: Current liability (creditors, accruals), non-current liability (long term loans)

- Revenue: Sales, and other income

- Expenses: Depreciation, direct costs (consumable supplies, freight in and out, sales commissions, etc.), expense (used for most parish expenditure items), overheads (manufacturing overhead, administration overhead, etc.)

- Equity: Retained earnings, reserves

Some account types are actually there for specific purposes. For instance, if you make a purchase and code the item to an account that is under the type – ‘Fixed Assets’, Xero will insert the item to the fixed asset register automatically.

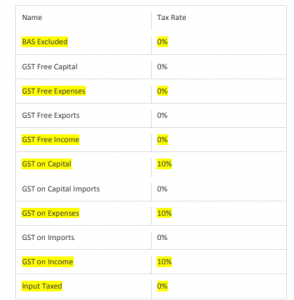

IV. Tax Rate:

Each account will have a default tax rate, which determines how Xero will enter transactions for GST purposes. The below-mentioned tax rates are available as default in Xero:

- 15% GST on Expenses

- 15% GST on Income

- GST on Imports

- No GST

- Zero Rated

When you add an account to the COA in Xero, you can select the tax rate and apply to the account. You can also make changes to the tax rate. GST is on the GST Return and GST Audit Report.

In case, while signing up to Xero, you select the option – no need to register for GST, the tax will not be apply to accounts in the default chart of accounts. If you later register for GST, you will be have to edit accounts in the chart of accounts to apply the appropriate tax rate as per the requirement.

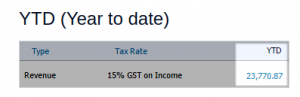

V. YTD (Year to Date):

Like other components, each account on the chart of accounts will have YTD, showing year-to-date balance, which is calculates the starting of the financial year, as already set in Financial Settings. The YTD balance represents as per the account type:

- Expense and Revenue Accounts: The balance shown here is the sum of all the transactions in the account for the ongoing financial year. By clicking on the YTD balance, you will get to see all transactions for that specific account, not only those for the current year.

- Asset, Liability & Equity Accounts: This balance is up-to-date as per the current date. By clicking on the YTD balance, you will have a view of transactions that adds in the balance.

The YTD balance will appear in the YTD column on your Xero dashboard, only if you select the account to show on the Account Watchlist.

Conclusion

It would be fair enough to say that Xero can help you manage your business financial accounting more efficiently while making it easier for you to view the charts of accounts, including balance sheets and profit & loss statements.

However, it is advisable to seek professional help when customizing the statements and analyzing the financial performance of your business. If it is getting difficult for you to take complete advantage of utilizing Xero, we, at Cogneesol, can help you as we offer Xero consultation.

If you want to know more about how we can assist you with your bookkeeping and accounting operations, contact us at +1 833-313-3143 or email us at [email protected] to schedule an appointment with our accounting experts.

Read Also:

Why Choose Xero as Your Accounting Software for Your Business?

Latest Blogs

This site is protected by reCAPTCHA. Google's Privacy Policy

and Terms of Service apply.