1000+

customers

50+ countries

across the world

Outsourcing leader

since 2008

Technology-driven

services

Stringent

quality processes

Accountants’ Role in Insurance Financial Reporting amid the COVID-19 Outbreak!

Last updated: 22 Aug, 2023 By Ashish Rana | 6 Minutes Read

Coronavirus pandemic has caused a lot of disruptions in the business finances and processes across the world. The traditional business models are failing to ensure smooth business operations and cash flow. If we talk about the insurance industry, it has been hit hard the most by COVID-19 since claim requests concerning coronavirus treatments and testing under the health coverage plans have created financial chaos for insurers.

This, in turn, impacted financial performance of the business, making financial reporting even tougher for accountants to manage. Insurance financial reporting accountants have to work really hard in order to produce different accounting reports and financial statements to the management who has to paint the actual financial picture of the company.

So, let us discuss what impact has the corona pandemic created on the financial reporting process of an insurance company.

Top COVID-19 Impacts on Financial Reporting

1. Liquidity and Ongoing Concern

It cannot be said till what time this pandemic will last, and this makes it an ongoing concern for insurers who are looking to preserve their cash flow. Companies really need to ask themselves, do they have enough cash opportunities to survive in the coming months? The existing and anticipated impacts of the corona pandemic will be needed for consideration by the management.

Due to a high uncertainty associated with financial impacts, there can be material uncertainties, leading to doubt in the firm’s capability to operate. Insurance Accountants who prepare financial statements keeping in mind this assumption must disclose every such uncertainty. Every insurance company is different and is affected in a different manner, so the financial assessment will vary from company to company.

2. Impairment Evaluation

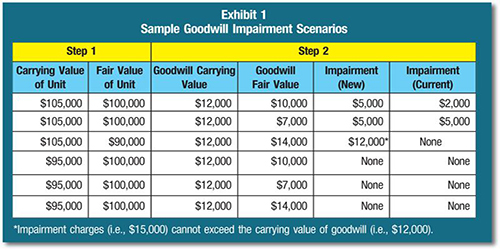

By the end of every reporting period, insurers are required to evaluate any possible impairment against non-financial assets. The impairment of an asset is done when a firm is unable to recover its current value, either through usage or selling. Due to the lockdown, the insurance companies have been unable to use their non-financial assets to their full potential, and this creates a possibility of impairment.

When firms assess impairment while preparing financial reports, they must figure out the recoverable asset amount. For this, accountants need to clearly calculate the ascertained future cash flow estimate, along with cash flow variation expectations. This estimated cash flow should be in alignment with the remaining life of the asset usage in the forecasted economic conditions.

3. Contract Alterations

The coronavirus outbreak was very uncertain when it started, and obviously, none of the insurance companies knew about what was in store for them in the future while forming contracts. However, due to the current series of events that are impacting the finances of insurers directly, alterations to the existing contracts can be made like amending the debt agreement terms, obtaining waivers in case they are unable to satisfy debt agreements, etc.

Firms will be required to assess if any change in the existing contracts can lead to contract extinguishment. If yes, it must be visible in the financial reports prepared by their accountants!

4. Fair Value Measurement

Insurance businesses need to assess the fair value of their assets and liabilities against a specific date based on certain assumptions with respect to the current conditions known to market participants. The Fair Value Measurement (FVM) will vary as per the COVID-19 outbreak’s severity and the value assumptions of the participants at that time.

Firms will be required to include these types of disclosure while getting their financial statements prepared by their accountants since it will directly influence the decisions of the general-purpose financial statements’ users.

5. Income Tax and Government Assistance

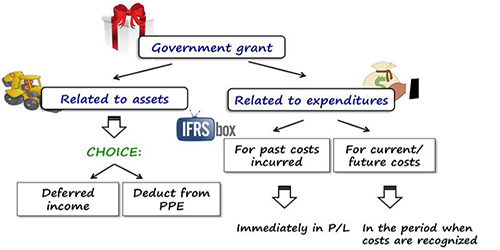

Ever since the corona pandemic started, the government has extended its full support to the businesses that were witnessing reduced or poor cash flow. These support measures initiated by the government include tax exemptions, reduction of public levies, direct subsidies, credits and tax reductions, rental reductions/deferrals, the extended expiry period of unused tax losses, low-interest loans, and more.

All these measures will have a direct impact on financial reporting. Relief measures might come under the standard scopes on financial instruments or leases, income tax, government grants, and the role of an accountant will vary in every case. One thing that the accountant must verify is whether or not the relevant laws concerning support measures have been enacted against the financial reporting date in order to include financial data accordingly.

6. Increasing Reporting Pressure

Every pandemic puts a lot of pressure on the professionals since they have to work in situations that didn’t exist before or ones they had never imagined. Similarly, widespread uncertainty and market volatility will put an enormous amount of pressure on the accounting and finance professionals.

Their role becomes even more challenging since working conditions are disrupted in every sense, and preparing financial reports under such circumstances is not going to be easy for sure. Financial reporting accountants will be required to report more frequently to investors, boards, stakeholders, and regulators since the situation is changing with the passing of every day for the insurers.

Conclusion

Coronavirus has made the entire world come down on its knees, and the insurance industry is not an exception to it. Halted or reduced business operations, along with the increasing number of claim requests is making things complicated for the insurers on the whole. During such times, preparing financial reports becomes more of a necessity since it is imperative to let yourself and others know of the financial situation of your company to seek financial and exemption support. However, the problem lies in preparing reports since financial data is hard to collect correctly under disrupted working conditions.

The role of accountants is challenging for sure here, but they can definitely tackle the situations with their relevant experience and skills. However, there can be times when things become overwhelming for them. To avoid such a scenario, insurers should seek third-party support to reduce the burden on the shoulders of their accountants.

Are you looking for a top-rated and renowned outsourcing partner for your insurance firm? If yes, you have come to the right place! Meet Cogneesol- One of the leading Insurance Business Process Outsourcing companies that have been providing unmatched accounting back-office support to insurers and businesses across the world since 2008. Start your free trial now!

Recommended Blog:

Insurance Outsourcing: Business Continuity Plan for Insurers!

Latest Blogs

This site is protected by reCAPTCHA. Google's Privacy Policy

and Terms of Service apply.