1000+

customers

50+ countries

across the world

Outsourcing leader

since 2008

Technology-driven

services

Stringent

quality processes

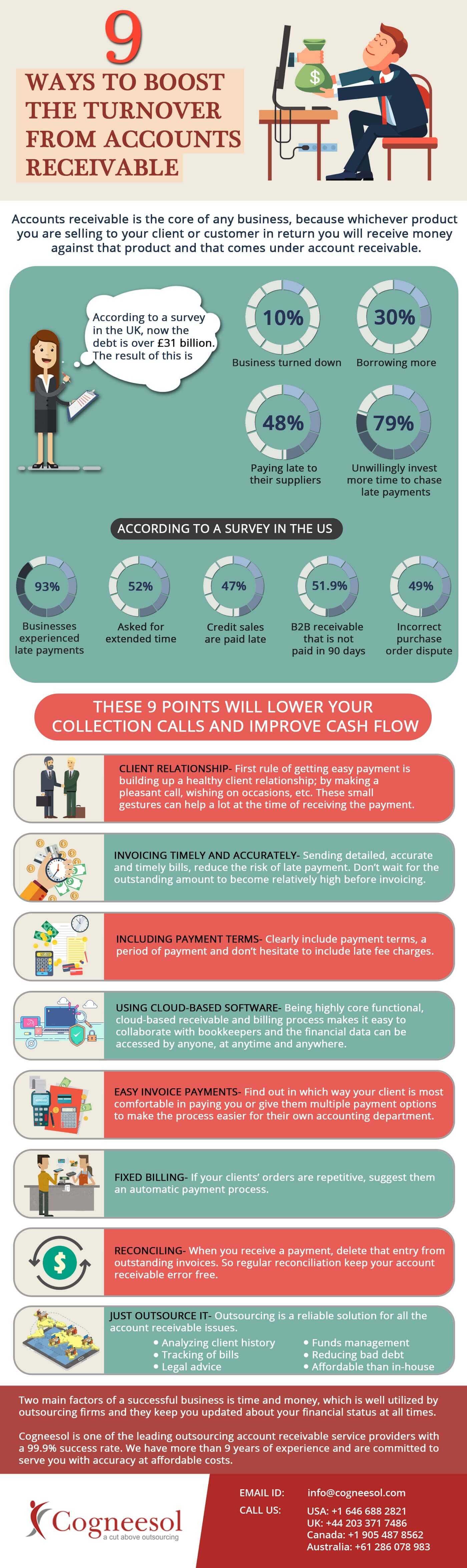

9 Ways to Boost The Turnover from Account Receivable – Infographic

Last updated: 30 Nov, 2023 By Ashish Rana | 6 Minutes Read

Improving accounts receivable turnover is crucial for maintaining a healthy cash flow and optimizing business operations. Companies often grapple with delayed payments, impacting their liquidity and overall financial health. But how to improve accounts receivable turnover? To address this challenge, implementing strategic measures can significantly enhance the turnover from accounts receivable.

Firstly, streamlining the invoicing process ensures prompt and accurate billing, reducing the likelihood of payment delays. Additionally, offering discounts for early payments serves as a compelling incentive for clients to settle their dues promptly. Embracing automation in the receivables management system helps expedite processes, minimizing errors and enhancing efficiency. Establishing clear credit terms and conducting thorough credit checks before extending credit to clients are vital steps to mitigate the risk of late payments. Regularly monitoring accounts receivable aging reports allows businesses to identify and address overdue invoices promptly.

Another effective strategy involves fostering open communication with clients to address any concerns or disputes promptly, promoting a positive and transparent business relationship. Implementing a proactive debt collection strategy and leveraging technology, such as predictive analytics, can aid in predicting and preventing potential payment delays.

By diversifying payment options and providing secure online platforms, businesses can accommodate varied client preferences and facilitate faster transactions. In conclusion, mastering how to improve accounts receivable turnover involves a holistic approach that encompasses efficient processes, proactive communication, and leveraging technology to ensure a seamless and accelerated receivables management system.

How to Improve Your Account Receivable Turnover: 9 Ways

Latest Blogs

This site is protected by reCAPTCHA. Google's Privacy Policy

and Terms of Service apply.